Uncover the invisible ROI of the benefits you most want to offer

Nearly a third of UK reward teams don’t know if their benefits actually work, and only 29% track what employees really think. And it gets harder when you’re trying to assess the impact of the difficult-to-quantify wellbeing benefits you need to truly elevate your offering. But with reward budgets under pressure and scrutiny on value increasing, you need to be able to shine a light on what’s working and why.

Drawing on new research from Octopus Money, this insight report looks at common value metrics, where they fall short, and how you can go the extra mile to justify the kind of innovative benefits that set your package apart.

Read the report to find out how to:

- Evaluate the quality of your metrics, guided by stats from UK reward professionals

- Go beyond broad ROI measurement to capture deep qualitative insight

- Elevate your offering with innovative value-adding wellbeing benefits

- Take your diversity and inclusion initiatives beyond recruitment

- Address your employees’ main worry with financial wellbeing support

- Scale your measurement as your company grows

Contents

- Introduction

- Different benefits, different measures

- Types of benefits

- Value-adding benefits: an opportunity for your team

- Choosing the best option

- The importance of financial wellbeing

- Company size: how growth affects your value metrics

- Exactly what should you measure?

- Is a full ROI measurement really viable?

- What are the options to show value

- Bringing measurement to life with deeper insight metrics

- Download the Octopus Money insight presentation

- Conclusion: seeing the big picture

- Practical measures to take

Introduction

Measuring the true value of any single employee benefit is difficult. It takes time and effort to show even an indirect connection to underlying metrics, and what you’re measuring is often intangible or hard to attribute to a single factor.

Can you really tie an individual benefit’s impact to underlying productivity and employee engagement rates? How do you illustrate the worth of the impactful wellbeing benefits you know your employees value? What happens when your company grows and the picture gets more complicated?

One thing is for sure: you need to feel confident that your budget is being invested in the right places, and you need to be able to effectively communicate success. Our survey found that senior stakeholders at 93% of companies want clear proof that employee benefit spending brings real value. If that value is not obvious, your benefits spend will face close scrutiny.

93% of reward experts surveyed are required to justify employee benefit spend

Despite its complexities, this challenge provides an opportunity to prove your team’s strategic impact by adopting the kind of benefits that elevate your offering, engage your workforce, contribute to your company’s wider goals and give you the data and insight you need to tell the real story of their impact.

With over a third of reward professionals (35%) admitting they struggle to track value effectively, what are the practical, workable options for effectively communicating value?

This report looks beyond the numbers, focusing on making the case for benefits that elevate your offering and improve the lives of your employees in a way that’s hard to pin down, with guidance on how to delve deeper into employee experience to highlight impact.

Different benefits, different measures

For the purpose of measurement, most benefits sit broadly in one of three categories:

Mandatory benefits

Such as pensions and paid time off (holiday, sick leave, parental leave etc).

Traditional extra benefits

Such as medical insurance, professional development and lifestyle perks.

Value-adding wellbeing benefits

Including mental and physical health support and financial wellbeing.

Mandatory and traditional extra benefits have a clear financial value to your employees (for instance how much they have in their pension, or the saved cost of medical treatments) which is clear to your stakeholders. Although producing a meaningful return on investment figure for your business is another matter, which is discussed later in this report.

Given they’re a legal requirement, the measurement of mandatory benefits is really a benchmarking exercise to find the most suitable solution for your employees, rather than a justification of their purpose. Similarly, most traditional extra benefits are known quantities where the business case will not need to include a justification of their basic premise. However, they are safe, straightforward (and often costly) options that won’t go far towards setting your benefits offering apart from those of your competitors.

There is likely to be more justification of value required for wellbeing-based, value-adding benefits which need to be:

- Bought in

- Embedded in your organisation

- Communicated effectively to your employees (as well as your senior stakeholders) to make their purpose and value clear.

Your board (and all of your employees) know why you offer a pension, but might not be aware of the full value of every kind of wellbeing support. So an especially strong business case is needed. Of the reward professionals we surveyed, almost twice as many (23%) put a greater focus on measuring wellbeing-based value-adding benefits than core benefits, reflecting the need for that stronger justification.

However, this kind of benefit is where you can truly differentiate your package by offering something innovative and of high worth to your organisation and employees.

Value-adding wellbeing benefits: an opportunity for your team

Despite the extra focus on proving value, the effort of finding and embedding this type of benefit is well worth it if you can demonstrate how it elevates your offering, engages your people and contributes to improving their wellbeing at work and quality of life. Value-adding wellbeing benefits can be a great way to set your offering apart as truly employee-focused and effective, if they come with a set of metrics that can form the basis of your reporting. When looking at options from external providers, it’s essential to find out what ongoing information they will provide to demonstrate success and make your reporting easier.

Offering this kind of benefit can also help grow the visibility of your HR team within your business by highlighting the contribution to high-profile business-wide ESG goals, particularly around inclusivity and social mobility. While many organisations factor inclusivity into their recruitment process, that’s often where it ends. This means employees recruited from a wider range of backgrounds are not being supported longer term despite often needing the support most, and your best diverse talent is not retained. Wellbeing-focused benefits can help redress the balance by supporting employees across all demographic and socioeconomic groups when they need it most.

Choosing the best option

There are many options for supporting your whole workforce’s wellbeing and strengthening your social mobility and inclusivity credentials, including employee assistance and counselling programmes (which are useful at the point where an employee is actively reaching out for help). But if you really want to improve lives, the key issue you should be considering is: what do people really worry about that affects their wellbeing while they’re at work? The answer is often simply: money.

The importance of financial wellbeing

Offering financial literacy and planning help can be a highly effective way for your organisation to support social mobility and inclusivity.

A genuinely accessible financial wellbeing benefit such as Octopus Money, which helps your people (regardless of job level, career stage or background) to discuss their finances, plan for the future and increase their financial resilience can contribute greatly to your organisation’s ESG commitments, as well as improving engagement and retention (financially settled employees are less likely to be looking for another job for salary reasons).

It’s also important for attracting talent: the Great Resignation changed the conversation between employers and employees, who want workplaces that support their financial wellbeing. According to the CIPD, 59% of workers say this matters to them, and in today’s talent market not providing the right support can cost you top candidates.

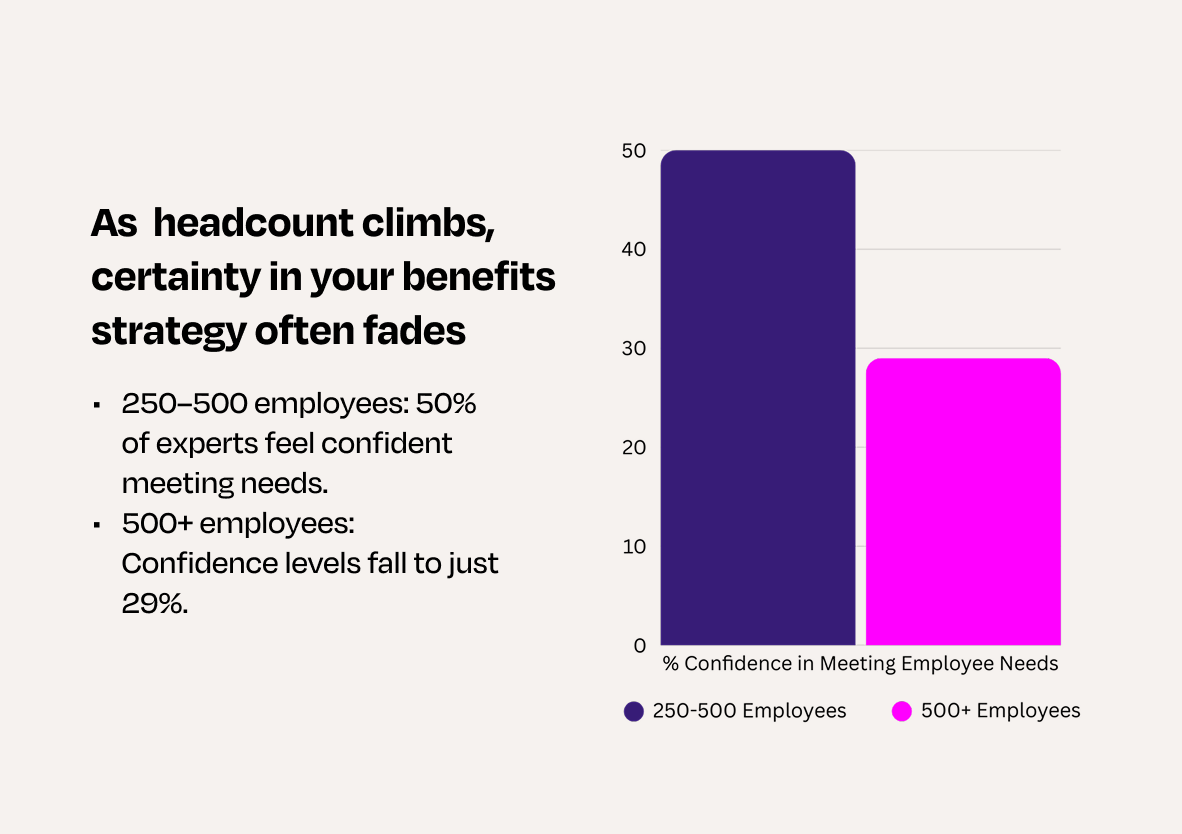

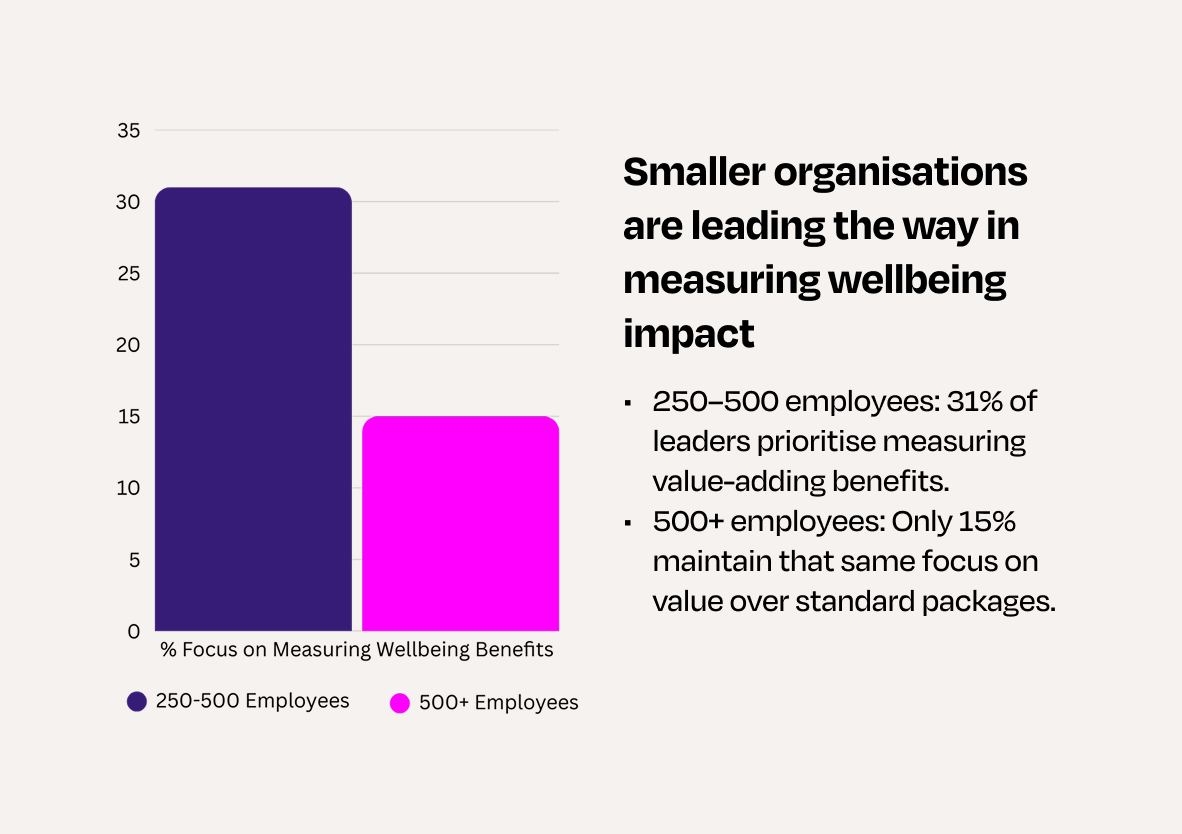

Company size: how growth affects your value metrics

As a growing company, it’s easy to see the impact a great employee benefit creates. Our survey data shows that smaller businesses appear much clearer on what’s working than larger ones:

Smaller businesses have a clear advantage: they have simpler structures and closer proximity to employees. But scaling your business shouldn’t mean losing sight of your people. As your organisation grows, you need to continue tracking metrics while also finding the tools that help you stay close to your employees and tap into their high-value insight.

Exactly what should you measure?

Is a full ROI measurement really viable?

In an ideal world, the precise impact of every individual benefit would be directly, financially measurable against key outcomes like wellbeing, productivity and employee engagement.

In reality, the most realistic option for many organisations is to use employee survey, eNPS and other data showing changes in those key indicators over time. This approach brings clarity to how employee benefits packages are performing by highlighting shifts in productivity, engagement and wellbeing. By weighing these improvements against the cost of your benefits, you can calculate and report a nominal ROI for your offering as a whole. Our survey found that 65% of reward professionals already use this method to link their benefits to key outcomes.

(Value of productivity + wellbeing + engagement) / cost of your benefits = Impact

However, that doesn’t give you insight into the value of specific individual benefits, and is difficult to achieve if – like 36% of our respondents – you cannot track the full cost of all of your benefits package to begin with, which puts even a nominal ROI beyond reach. And the numbers alone don’t fully illustrate the real-world positive impact that truly transformative value-adding benefits can bring to your employees and organisation.

What are the options to show value?

There are a number of value measurement options available depending on the data you have available.

- Basic uptake: what proportion of your employees has taken the first step?

- Continued engagement: How many people have continued their journey?

- Broad outcome indicators: changes in employee engagement, retention, productivity and absence during the lifetime of the specific benefit.

But there is value to be found beyond the basic numbers.

Bringing measurement to life with deeper insight metrics

Beyond calculating the numbers and trying to demonstrate an ROI, the real story of your benefits comes from seeing how your employees actually use them. It’s hugely valuable if you can capture meaningful qualitative insight into who is engaging with the benefit and how, broken down by the key demographics of your workforce to show how far its reach really extends.

If your benefits providers can give you this insight, it can make your reporting easier and highlight the value your initiatives bring to your organisation. And if they can’t, are they really providing you with value in the first place?

Deeper insight metrics include:

- Levels of engagement through the benefit’s journey: sign-up, continued usage and uplift to higher levels of service

- Testimonials showing how the benefit is used in practice and how it affects the lives of your employees

- Engagement across demographics including age, gender and salary level and how they compare, highlighting groups that need extra support to engage

- Key priorities, concerns and confidence levels throughout the journey

- The overall impact on employees’ wellbeing

This data brings to life exactly how useful the benefit is to your employees and who in your workforce is particularly engaged with it (and who isn’t). This can be presented to your board, exec team or stakeholders to paint a picture of not only where the value lies for your employees, but also the areas where work needs to be done and the specific groups who might need additional support.

To see how the Octopus Money benefit takes the guesswork out of value measurement for our partners and brings their employees’ financial wellbeing journeys to life, download our sample insights presentation.

Conclusion: seeing the big picture

Proving the true worth of your benefits isn’t just about numbers, it’s about the bigger picture of your employees’ experience. As your business grows, it’s vital to continue capturing the deeper, meaningful insight which brings your employees’ experience to life and illustrates value in practical terms. While specific ROI calculations may not be exact or always realistic, a combination of engagement trends and rich demographic insights creates a solid case for what’s actually working.

For UK reward professionals operating under increasing budget scrutiny, evidencing impact with this kind of insight is key to offering a benefits package that genuinely delivers value for both employees and the business.

Practical measures to take

Adoption

Measure initial benefit uptake. What’s the adoption % in your workforce?

Engagement

Measure continued usage and engagement. What’s the drop-off of interaction over time? What are the most common second steps?

Sentiment

Measure the underlying change in key metrics (engagement, wellbeing, retention) over the time of the benefit’s implementation through employee survey and NPS data.

Visibility

Work out a nominal ROI % for your whole benefits offering (if the data is available):

(Financial value attached to increased employee engagement and wellbeing / Cost of benefits) x 100.

Validation

Show the true-life value of your individual benefits with deep insight into the stories of how your employees engage with them.

At Octopus Money, we bridge the gap between benefit spend and business impact through proven wellbeing support.

Research methodology

Unless otherwise cited, the data in this report comes from research carried out by Censuswide on behalf of Octopus Money. Fieldwork took place between 16-26 December 2025, polling a sample of 250 reward and benefits professionals at manager level and above. Findings reflect the current picture and may evolve as market conditions change.