Give employees clarity and confidence with a personal financial plan

Financial planning used to be reserved for the top 10%. We’ve reinvented the model to make it accessible to every employee – no matter how much or little they earn.

How it works

After their free 1-to-1 session, employees can choose to build a personalised financial plan with their coach or adviser using our interactive planning tools

- See all their finances in one place – projected from now to retirement

- Add financial goals

- Plug in different scenarios to visualise the impact of their choices

- Get personalised recommendations and actions

- Receive ongoing support to follow through on their actions

Employees with a financial plan are significantly more likely to feel financially secure, confident, and in control.

£289,320

The average employee we support retires over £200k better off thanks to planning

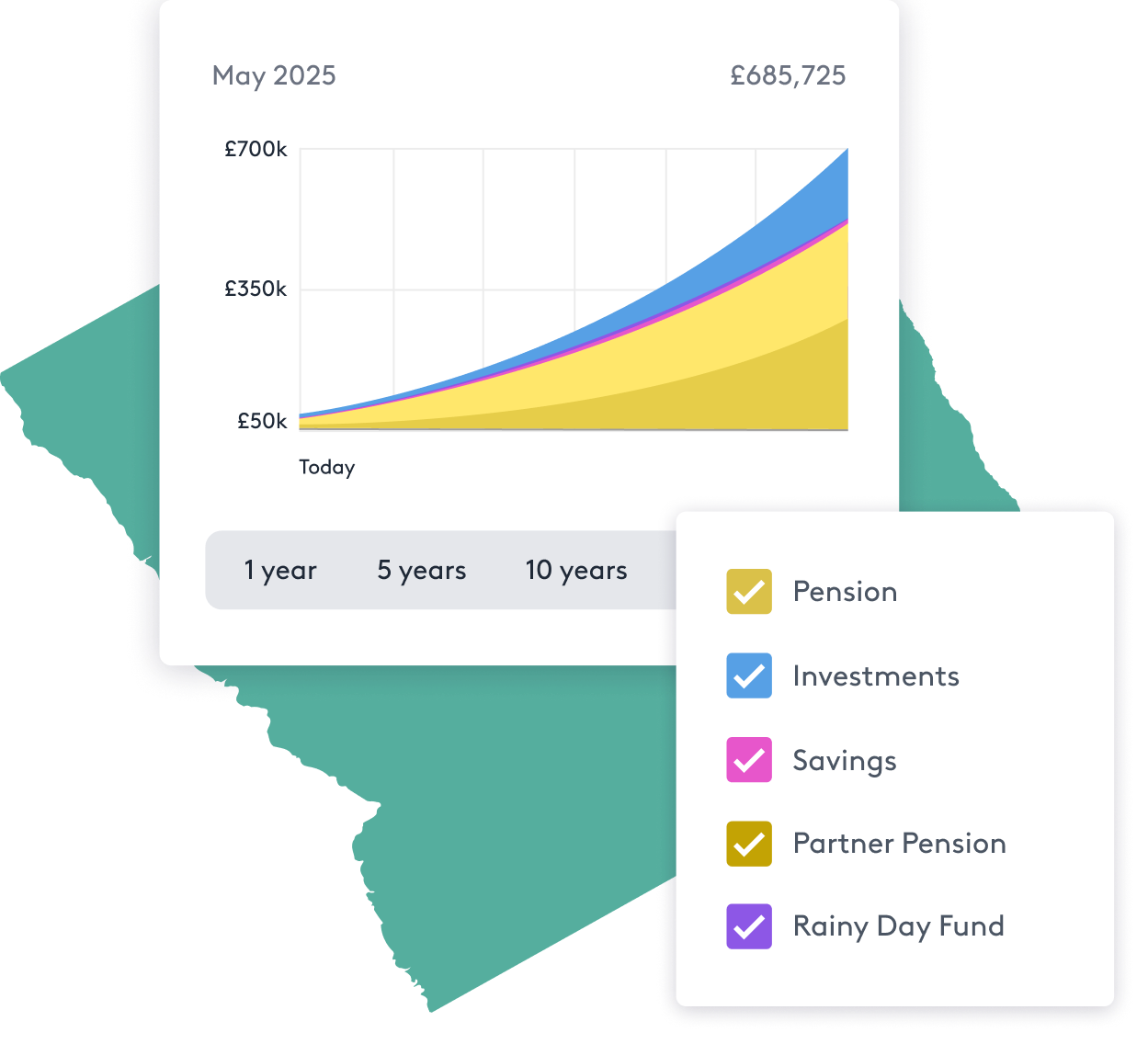

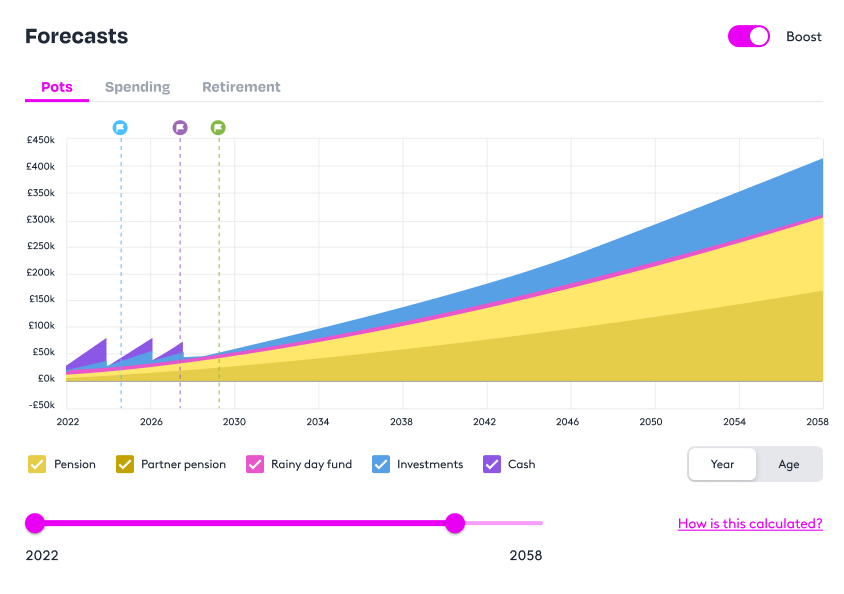

See a long-term forecast of all your finances – all in one place

Employees get a personal cash flow forecast that brings together income, spending, savings, investments and pensions – giving them a single, joined-up view of their financial future.

Add goals to your plan with the help of your coach or adviser

From growing a family to moving house, employees can add life goals that matter to them – and get clarity on whether or not they’re on track.

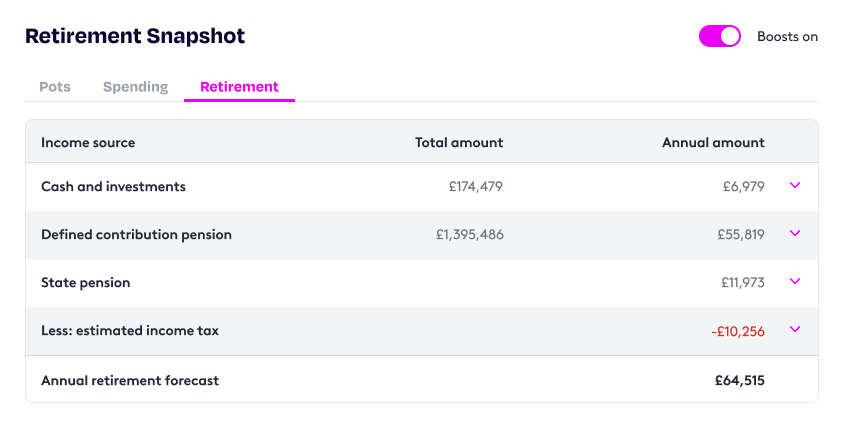

Explore your retirement outlook – and how to improve it

Employees can see how their retirement is shaping up – and explore ways to improve it, including how to make the most of their workplace pension.

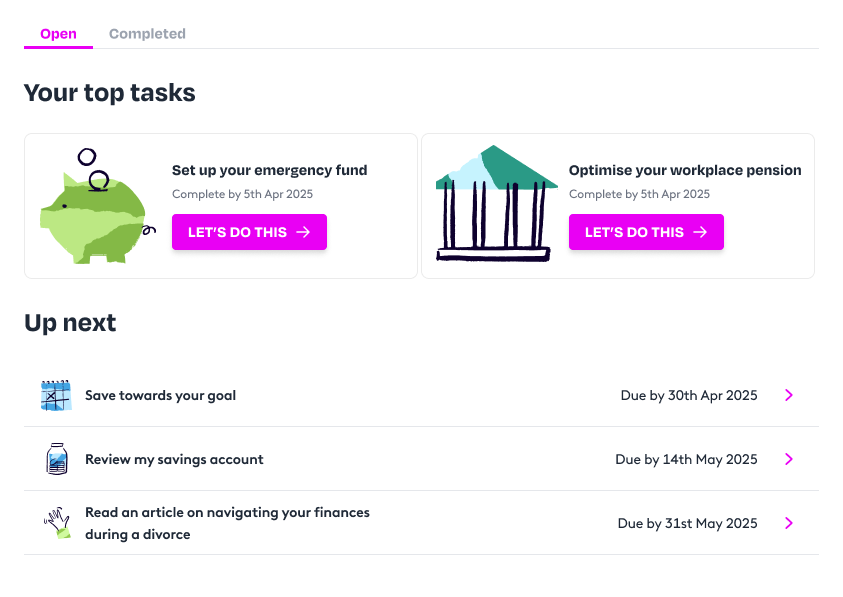

Keep track of your actions and measure progress along the way

We break each goal into simple, achievable steps and offer support to help employees follow through.

Your senior leaders get access to a dedicated wealth planning team – with expert guidance tailored to more complex needs.

From managing investments to planning around tax, bonuses, and long-term wealth, our specialist advisers provide the level of personal support senior leaders expect.