Workplaces

The financial wellbeing benefit your people will use

We make it easy for employees to get expert, 1-to-1 support with their finances.

Trusted by some of the best UK employers

100,000s of employees have access to Octopus Money

We help 100% of your employees feel financially secure at every stage of life

- Starting a career or navigating student loans

- Getting married or divorced

- Growing a family

- Buying or renovating a home

- Supporting aging parents or dealing with loss

- Planning for retirement

Let’s be honest – your team’s biggest worry is money.

How we can help

You need financial wellbeing support that is…

Human

Real conversations with real experts – not chat bots

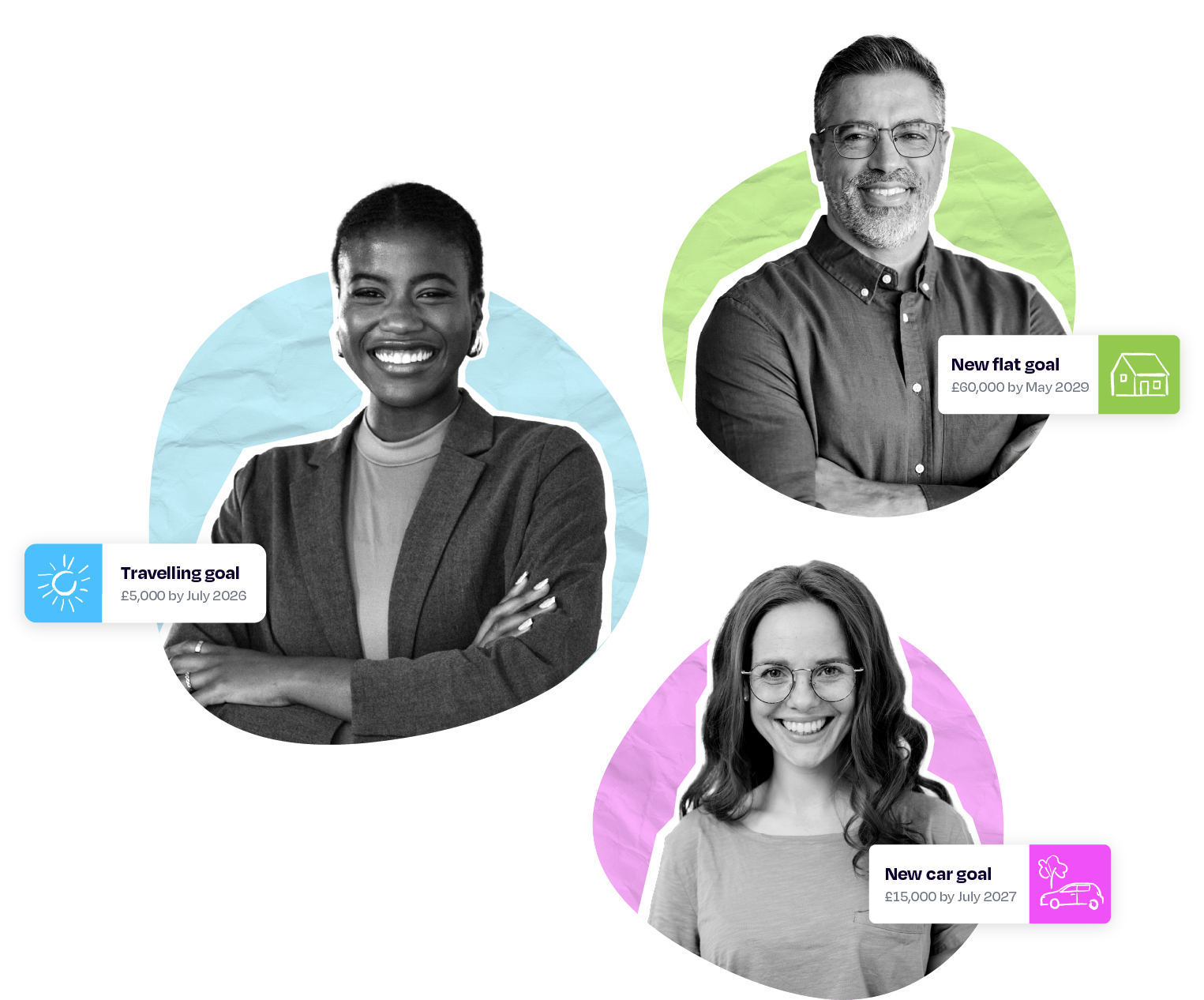

Personalised

Support tailored to each employee’s unique goals and life stage

Holistic

Helping employees put all the pieces of their finances together – budgeting, savings, pensions, investing and more.

Action-Oriented

Going beyond self-guided education to help employees make the changes that really matter

Connected To All Your Benefits

Making the most of everything you already offer

How Octopus Money works

It starts with a conversation – and ends with a personalised plan employees actually follow through on

Every employee:

- Is matched with the right money expert and booked into a free 1-to-1 session

- Can go through a tailored journey to build a personalised financial plan

- Can map our their entire financial future – and explore different scenarios

- Can get clear, step-by-step recommendations to help reach their goals

Not all financial wellbeing solutions are created equal

Here’s how we’re different

Swipe left to compare | Octopus Money | Standard Coaching Offerings | Digital Financial Wellbeing Platforms |

Approach | Proactive, structured journey for every employee – proven to drive action | Light-touch, ad hoc sessions or hotline | Self-guided educational content |

Access | We proactively invite every employee to a scheduled session to ensure engagement | Basic guidance for most – deeper support typically reserved for higher earners | Content pushed to employees via email, chat or portal |

Depth of Support | Personalised financial plans, with specific recommendations, built side-by-side with employees | One-off conversations with limited follow-up | Articles, videos, and nudges |

Tools | All-in-one interactive financial planning tools – bring all the pieces together | Limited or no digital tools | Standalone tools (e.g. budget builder, pension calculators), but without a joined-up plan |

Human | Real advisers and coaches who stay involved to support action and track progress | One-off conversations with limited follow-up | Little to no human support – digital only |

.wp-block-column.is-layout-flow.wp-block-column-is-layout-flow a {

text-decoration: none;

}

Everything you need for a joined-up financial wellbeing offer

We make your pay and benefits go further

Most people don’t make the most of their salary or benefits.

We help them understand how it all fits together – and how it supports their life goals.

78%

know how to make their money stretch further

85%

feel more on track for the financial future they want

74%

see themselves staying at their company for longer

Trusted by employers to retain their top talent

Our story

Over 25 years of industry experience

We’re part of the Octopus Group – a family- and employee-owned business that’s been doing things differently for 25 years. We set out to build businesses that will outlive us and create a better world for future generations.

2000

It all started with Octopus Investments. Today, that company manages over £10 billion of assets and offers investment solutions to help with estate and tax planning.

2015

Octopus helped launch Octopus Energy – now the UK’s most loved energy provider, with a mission to make energy better for people and the planet.

2023

Octopus Money was born to fix another broken system – making high-quality financial advice available to more people at a fair price.

Values-Led

As a certified B Corp, we’re committed to doing what’s right – for people, partners, and the planet.

Privacy and Security

We’re ISO/IEC 27001 certified, with rigorous data protection and security standards to keep employee information safe.

Proven Experience

We’re part of Octopus Group, with 25+ years of expertise in financial services and a track record of trust.

Protected

We’re authorised and regulated by the Financial Conduct Authority. All employee calls are recorded, with regular reviews by our quality and compliance teams to maintain and improve standards.

Monthly insights for people leaders

Thought-provoking perspectives and trends from our team of consultants and coaches.

Frequently Asked Questions

What are the most popular features of Octopus Money?

For employees, the most popular features from Octopus Money are the ability to:

- Get a visualised year-by-year forecast, all the way to retirement, so employees can be confident making bigger financial decisions

- Find out how much to save, invest and put into pension to reach your goals

- Keep track of the money actions you agree with your coach

- Add your partner’s finances

Are you FCA-regulated?

Yes.

However, our money coaches will not provide regulated “financial advice” to your employees. For example, they will never recommend specific investment products or funds to your employees. Instead, they will offer impartial guidance and education, helping employees understand the pros and cons of different options so they can make more informed decisions.

Some employees with more complex circumstances can choose to meet with a regulated financial adviser from our team and receive regulated financial advice.

Why do your costs qualify for tax-efficient salary sacrifice?

In 2017, a bill was passed allowing an employee to receive up to £500 p.a. of ‘pension advice’ as a non-taxable benefit. Every employee that works with a coach or adviser to “Plan Their Goals” will get a personalised retirement plan to help them make better decisions about their pensions. You can read more on our approach to pension advice here. And here’s the full details of EIM21803.

How is Octopus Money different from other financial wellbeing providers?

Take our word for it…”money advice for everyone” is hard to do properly. We have been built from the ground up to do just that – delivering the very best 1-to-1 support for all of your employees, at the best price possible.

- We’re proud to be one of the first and most established providers of money coaching and other financial wellbeing services in the UK.

- We’re FCA-registered for Financial Advice, an Associate Firm of the Personal Finance Society and recognised by the Initiative for Financial Wellbeing.

- We’re building the UK’s biggest and most diverse community of accredited coaches, which allows us to support companies big and small.

- Our team uses professional-grade planning tools to build a personalised plan and action list for every client.

- We take direct and ongoing responsibility for training, supervising and monitoring all of our team – that means clients aren’t passed on to an unknown parties for support.

- Finally, you can trust that we have long-term stability and backing because we’re part of Octopus Group.

How much does it cost?

The cost of the service depends on a few factors, especially the uptake you want to see from your employees. But we offer options for all budgets.

Get in touch with our teams and they can share a custom quote for your business.