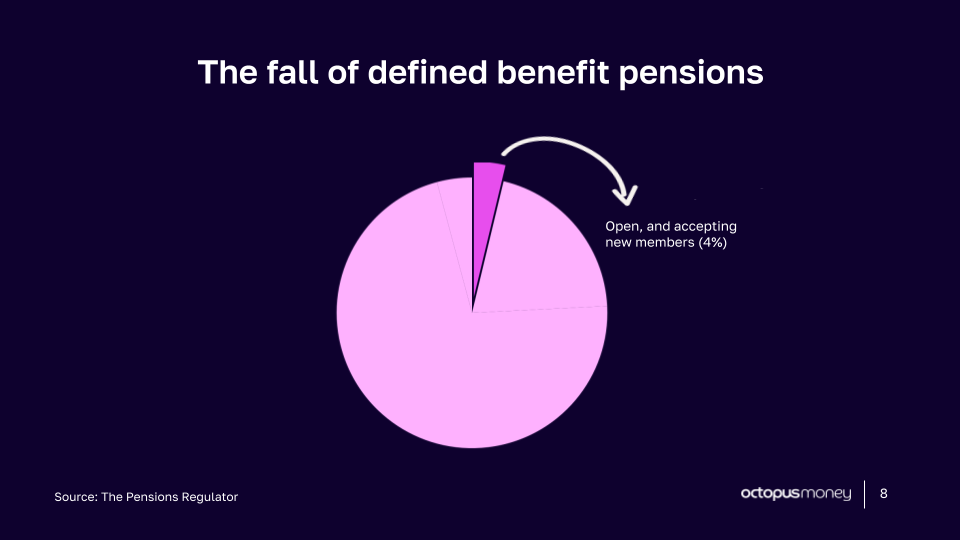

Times have changed

Our parents’ generation didn’t have to think too much about their pensions. With generous final salary pension schemes even lower earners’ pensions were much healthier. Nowadays it isn’t enough just to assume that if you have a pension you’ll be set for retirement. Only four percent of pension schemes accessible to today’s workers are defined benefit.

There’s been a huge shift of responsibility from the employer to the employee.

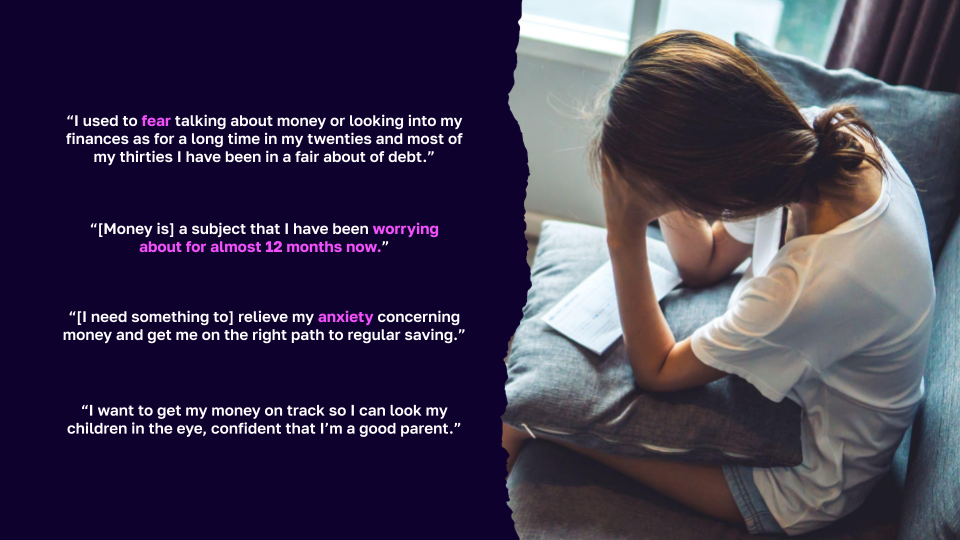

It has a real impact

It leads to a lot of stress for people. When people are worried about whether they can retire it has a knock-on impact in lots of areas of their lives.

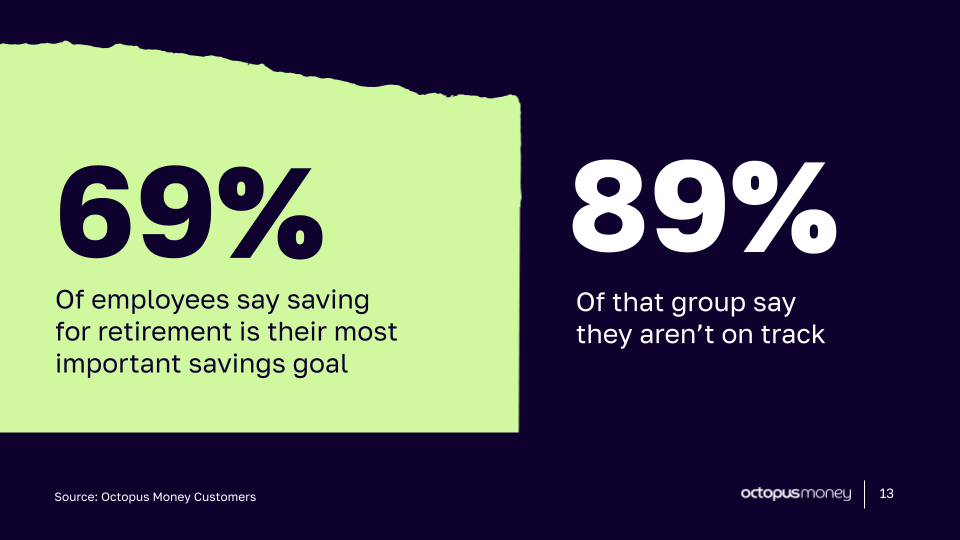

The numbers are pretty shocking

If you looked at any other part of your business, and said that the most important goal for 69% of people wasn’t on track for 89% of them, you’d be in crisis meetings.

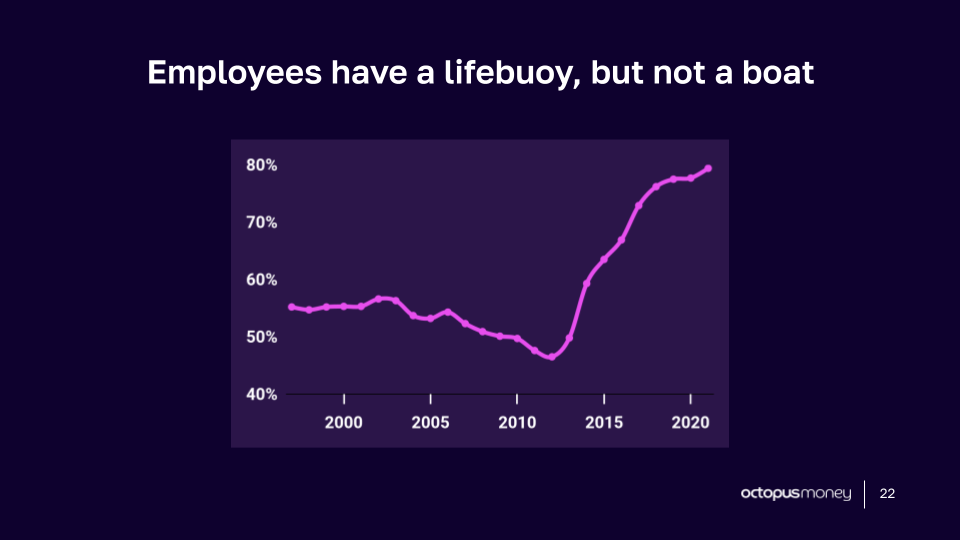

Auto enrollment is a lifebuoy, but not a boat

Thanks to the launch of auto enrollment, more people than ever are paying into their pension, which is great. But it isn’t enough. If you look at the average contributions, they still aren’t enough for a comfortable retirement

What employers can do to help fix it:

Pensions are personal

Pensions can be complex, and they’re unique to each person. Plus, they’re unlikely to be things that people will ask about in a group session. Health problems, or plans for having children aren’t things people talk about in public forums. 1-to-1 advice is key.

Sort the medium term before the long term

People can’t think about their pensions if they’re struggling now. They can’t fix the medium term until the short term is fixed.

Safe spaces are powerful

As well as 1-to-1 advice, creating small groups with peers where they can share their experiences that may be specific to their community can help people.

Leadership trumps paperwork

Standing in front of your employees and letting them know that you get help with your money can really help to break down barriers. Much more than providing people with lots of information that they can struggle to understand. Financial advice shouldn’t just be for the wealthy.

Give everything people need in one place

With people losing track of their pensions from previous workplaces, it’s hard for people to feel in control if they can’t see everything in one place. Pension tracking dashboards can really help with this. Some providers allow you to add different pensions to their dashboard without consolidating them.

If you’d like to give your employees 1-to-1 money advice then we’d love to chat.