Dentsu is one of the largest marketing and advertising agency networks in the world, supporting brands at every stage of their customer journey.

Elevating A Wellbeing Strategy

With over 4,000 UK employees, the business sits at the heart of the UK media industry, where competition for the very best talent is as high as it gets. Sam Wilkerson, Reward Analyst, says that recruiting and retaining brilliant people are two of his team’s biggest priorities. That’s why, in 2022, they commissioned an independent review of their rewards and benefits to ensure they were offering the very best support.

During the review, Sam says they found “an opportunity to elevate their financial wellbeing offering.” Dentsu was already a financial wellbeing leader, offering digital tools and financial education to their employees – not to mention, 3 wellbeing days a year, mental health first aiders and an EAP in place. But since their last benefits audit, the financial wellbeing landscape had evolved to a new phase, focused on delivering personalised 1-to-1 guidance for employees.

Sam acknowledges that “the benefits landscape has become complex” and “there are many more providers” as financial wellbeing becomes a hot topic. In the end, they decided to partner with Octopus to match every employee with their own money coach. It’s now become a key part of their strategy to attract and retain great talent. At a time when budgets in every industry are being scrutinised, Dentsu has also been able to deliver the service in a way that’s cost neutral. All employees get a free session with their coach and then have the option to sign up to the full service via salary sacrifice.

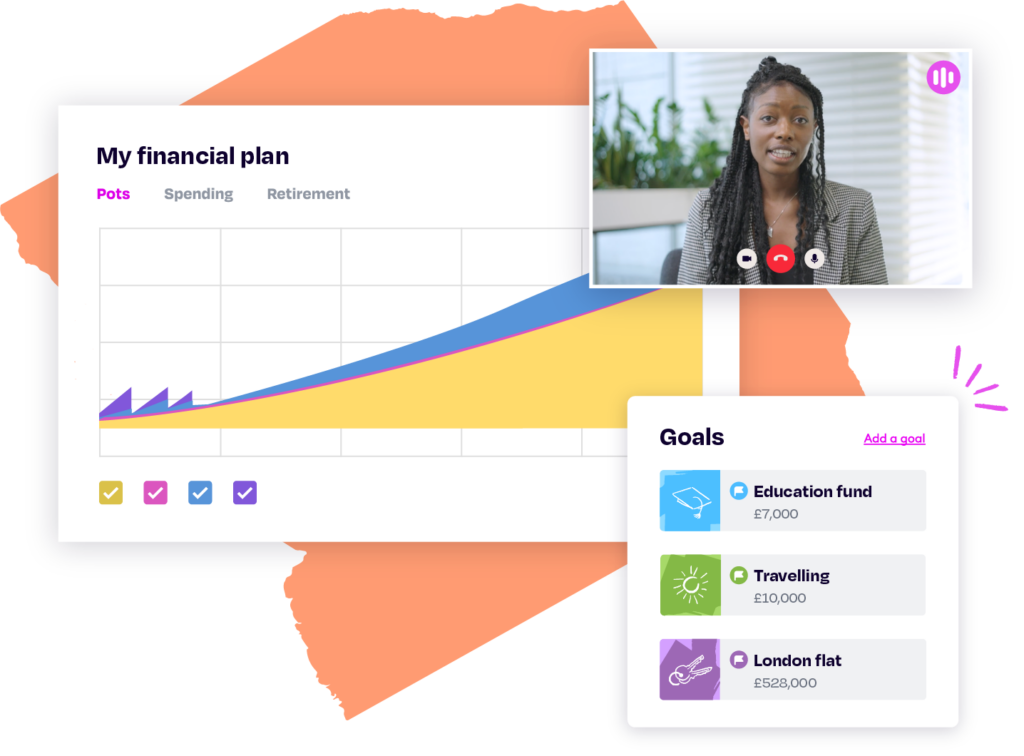

See it for yourself

Chat to one of our team for a no-obligation demo and find out why Dentsu made financial coaching a key part of their benefits offering.

Personal, Human Support

The timing was fortuitous: as the cost of living became a national concern, Sam says they “felt fortunate that we already had this support in place.” But for Sam, the value of a personalised financial wellbeing program goes beyond the current economic climate. “As employers, we’re responsible for providing our people an income – but we haven’t always provided a resource to help them use that money to the best of their ability.” Money coaches meet with employees and discuss their personal goals as well as their financial situation. They then build a personalised plan of action to help employees live the life they want, now and in retirement.

Sam says it’s the “human touch” that sets Octopus apart.

“You can read all the articles you want, but it’s great to have a friendly face to talk to, to bounce ideas off of and to explain things in a relatable way. Coaches can really understand your situation and then point you in the right direction.”

Off-the-Charts Engagement

The impact at Dentsu has been phenomenal. “You only need to look at the stats to know how popular it is,” Sam says. Over 1,200 employees booked in to speak with their money coach. And after all of those sessions, the average employee review of the service is 4.9 out of 5 stars.

So how do you achieve such good engagement in a business as big as Dentsu – especially when so many benefits fail to engage? Natalie Pullen, Reward Director, UK & Ireland, gives some credit to how the benefit was launched to employees. “We picked a period where it would get lots of air time. And then we got really good buy-in from our senior leaders, who spoke about it in all of our town hall meetings.” Sam adds that “all our mental health first aiders are briefed on Octopus, so that they can direct colleagues to the right support if they need it.” In addition, every employee received a personal email from their coach, offering a specific time to meet. “I don’t think we’ve ever had such good take up,” he says. “It has now set the benchmark for all our benefit launches.”

When you ask Dentsu employees, it’s clear just how much they value the benefit. One employee said their coach “was able to give me quick yet specific advice after only a few minutes of talking through my financial situation.” Another says that “after years of confusion and bad [financial] habits” they appreciate that their coach “is very personable and recognises my need for some emotional (not just purely financial) support.” Another employee declared themselves “a passionate advocate” for the service after just 1 session and expressed appreciation to Dentsu for giving them “the opportunity” to work with a money coach.