Browne Jacobson is the full service law firm committed to making a positive impact across business and society. In one of the UK’s most competitive markets for the very best talent, the law firm stands out by putting culture, D&I and wellbeing at the heart of their employee proposition.

Over the past few years, they’ve made a name for themselves as both forward thinking and innovative in how they approach diversity & inclusion, wellbeing and employee rewards. In fact, the Social Mobility Foundation has named them the UK’s top employer for social mobility for two years running – landing ahead of even large corporates 10x their size.

“We’re constantly scanning the horizon and looking for forward thinking benefits which align with our values and help us attract and retain the best talent,” says Adam Fox-Everitt, Head of Reward.

A Financial Wellbeing Journey

When it comes to financial wellbeing, the firm has been on a journey. Browne Jacobson provide access to impartial, self-guided learning for employees to help people take control of their own finances, but are becoming increasingly targeted in their approach.

The firm employs a diverse workforce on a wide range of salaries, from lawyers and senior managers to admin and support colleagues. “We can’t make any assumptions that anybody already has healthy money habits in place. And we can’t expect that everybody is going to log in to an app and read through financial wellbeing articles. You probably have to be fairly engaged in personal finance already to take the time to do that. Plus, there’s so much content available now, it’s easy to get lost.”

The Next Wave

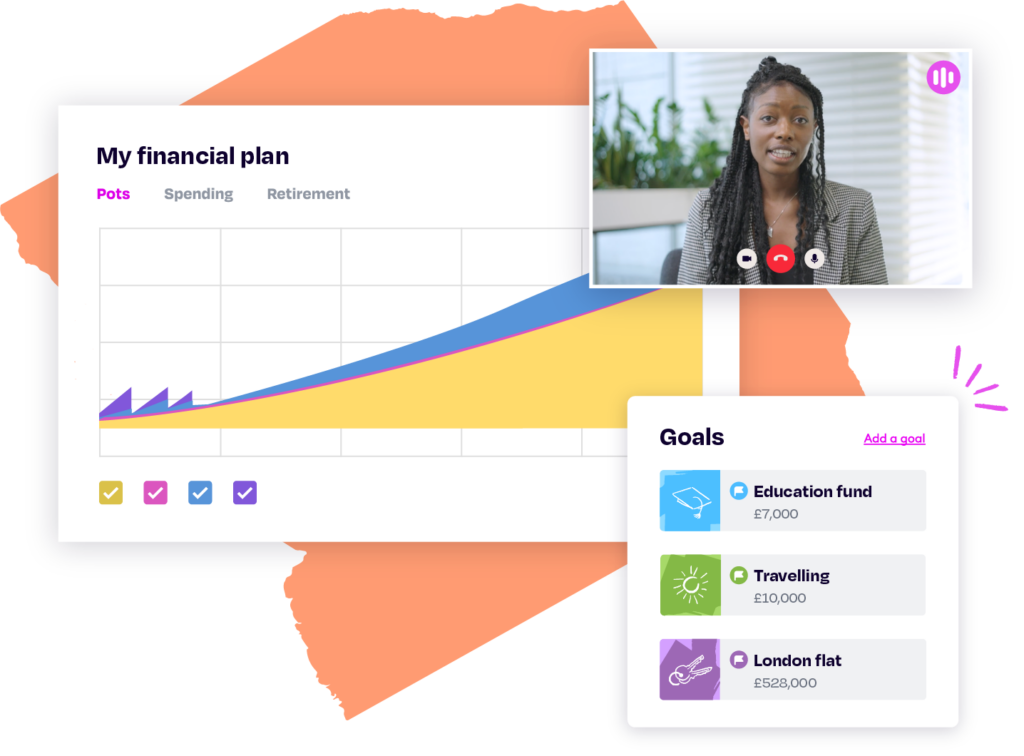

While scanning the horizon for the next generation of financial wellbeing, Adam’s team came across Octopus Money. They quickly fell in love with the personalised, 1-to-1 support they could offer all of their employees.

“We realise that ‘one size fits all’ actually fits no one. But coaching is different. Whatever is on your mind, you can go talk to your money coach and they’ll guide you in the right direction. They can adapt to what each colleague really needs.”

And given Browne Jacobson’s focus on positive societal impact, Adam says, the team likes that “coaches are outcome-oriented,” focused on ensuring employees make tangible changes in theirs and their families lives.

See it for yourself

Chat to one of our team for a no-obligation demo and find out why Browne Jacobson made financial coaching a key part of their benefits offering.

Impact

Since launching Octopus Money, he’s proud to say it’s “a big leap forward” for Browne Jacobson’s financial wellbeing proposition. “We’ve had amazing feedback. It’s like a personal trainer for your wallet. Coaches have the time to really understand employees. Then, they conjure up a plan for you.” Unlike the purely self-guided approaches to financial wellbeing, “it takes a lot of the guess-work out of getting started.”

At Browne Jacobson, everybody gets a free 30-45 minute session with their coach and then they can decide whether they want to pay for further support via salary sacrifice. “The free session really helps to break down barriers and helps more people get involved.”

Of course, he and his wife have now taken advantage of the money coach experience too. “I’ve been impressed and even taken aback at the quality of conversation with my coach and how it’s made me think about things bigger than money. For me and my family, it already paid for itself after just 2 sessions.”

Adam’s big takeaways on financial wellbeing

- If D&I is a priority for your business, make sure your financial wellbeing programme actively supports employees coming from a variety of backgrounds and socio-economic environments

- Money can be a dirty word and a trigger for anxiety. So remove as many barriers as possible for employees to get the guidance they need. Ask yourself ‘where can they go when they don’t know where to start?’

- Financial education is a fine place to begin, but to have real impact, make sure your strategy is actions- and outcomes-oriented