Make your money work harder for you

Put your investing on autopilot – with personalised recommendations for you and 1-to-1 help from your own dedicated coach or adviser.

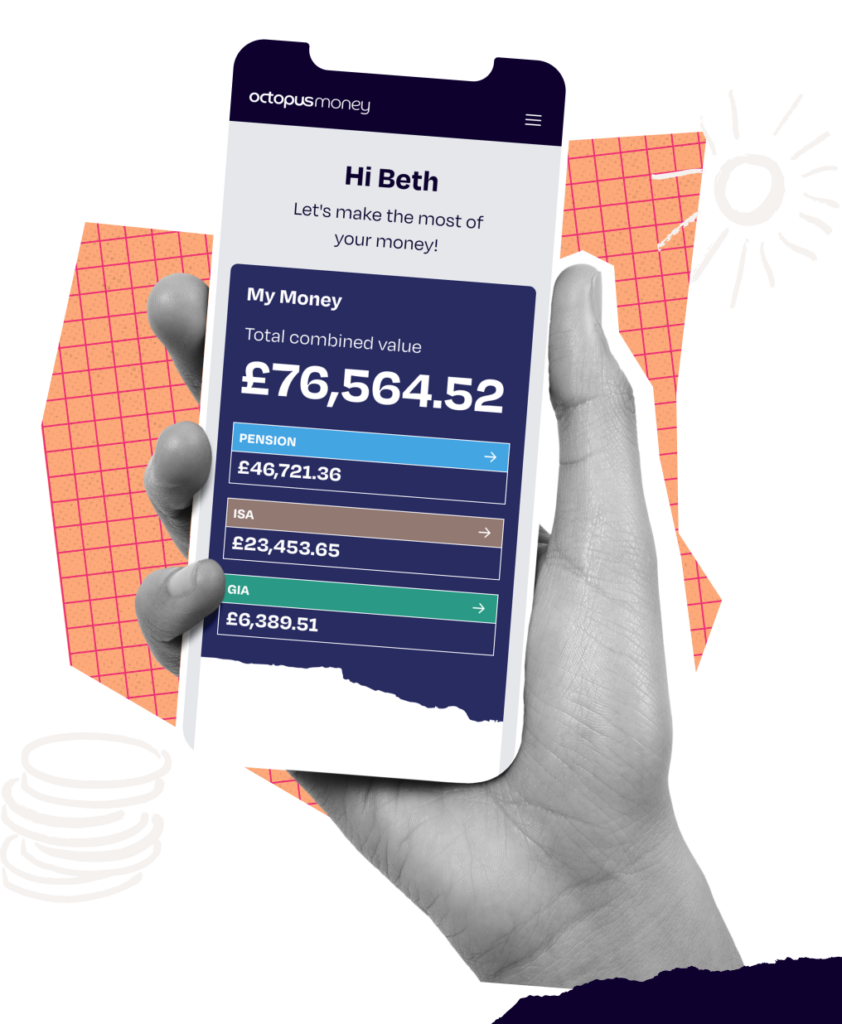

Get the full picture, with all your finances in one place

☑ Your unique financial plan

☑ Personalised investment guidance

☑ A pension to meet your needs

☑ Portfolio and performance info

Invest in the way that’s right for you

Let us take the guesswork out of investing. We’ll help you make sure you’re saving the right amounts for the future you want and recommend a personalised portfolio that meets your needs.

How it works

STEP 1

There’s no ‘one size fits all’ solution when it comes to investing. So we start with understanding you and your goals.

STEP 2

When we know what’s important to you, we build you a custom financial forecast and plan, to give you a full picture of your finances.

STEP 3

Our digital advice tool will match you with the optimal portfolio, from our our range of expertly managed, whole-of-market portfolios.

STEP 4

We’ll transfer over your money in any existing investments, and look after these on your behalf year after year.

See it in action

Why choose to invest with Octopus Money

See how our service stacks up compared to the most popular investment providers on the market

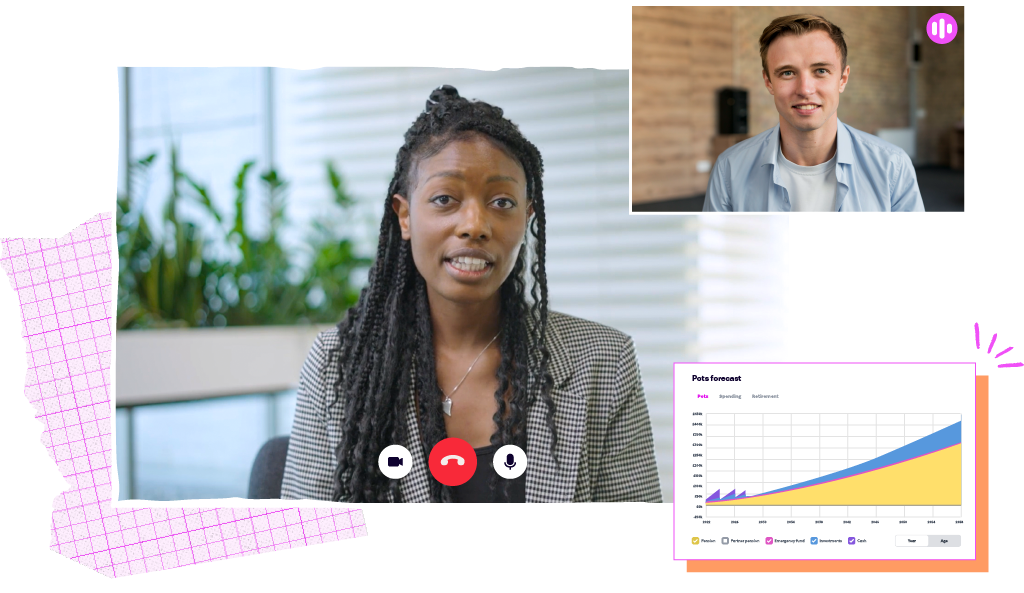

Money help from a real human

Life changes all the time – so we’ll meet with you 1-on-1 to review your financial plan every year.

Plus, talk to a real human whenever you have questions.

Frequently Asked Questions

Why should I invest with Octopus Money?

The Octopus Money investment accounts, powered by our ongoing advice service, include 1-to-1 financial planning and regulated investing advice, designed to help you improve your financial future.

We can help…

- Recommend and manage the investments which suit you

- Recommend how much you should contribute in order to reach your long-term goals

- Keep you on track with included access to financial coaching, planning and content

- Make it simple for your to review and manage your long-term investments alongside your financial forecasts

Will my investments be in safe hands?

Yes! Your money will be in safe hands.

Octopus manages over £13bn* of investments. In addition, the Financial Services Compensation Scheme (FSCS) protects your money, up to £85,000, in the event that your investment firm fails.

*Funds under management data includes undrawn commitments, funds under advisory mandates and funds monitored. It also includes funds under the management of Octopus Renewables Limited. As of 30th September 2023.

What services does Octopus Money offer?

Octopus Money offers a range of services that covers everything you need to plan your future, and optimise your short, medium and long term finances. This includes:

- Money Coaching, Planning and Advice – We are the UK’s largest provider of money coaching, and our teams of coaches, planners and advisers use powerful technology to help clients plan their future and optimise their finances.

- Savings, Investments & Pensions – We help clients to grow their money for the medium and long term, and provide advice on how much and where to save and invest.

- Other Financial Services – We also provide help with mortgages, life insurance, wills and lasting power of attorney.

Who is Octopus Money?

At Octopus Money we’re on a mission to help millions of people turn their life dreams into reality by sorting their savings, investments, pensions and more.

Through a mix of real, friendly people and really clever technology, we help you connect the dots between the life you want to live and the choices you make with your money.

We’re a certified B-corp – and yes, our famous sister is green energy game-changer, Octopus Energy.

We’re excited to help you invest your hard-earned money and introduce you to all of the ways we can help you make your money go further.

Who is it for?

We’re making financial planning and advice more accessible for everyone. That means for anyone who wants to make more of your money and feel confident they’re on track to reach their goals.

Here are just a few of the reasons we hear most often from clients:

- “I want help buying a property.”

- “I’ve got kids on the way and I want to make sure my finances are in order.”

- “I’ve got several big goals in mind and I want to check I’m saving for them all in the best way.”

- “I’m thinking ahead to retirement and want to make sure I’m going to have enough.”

Unfortunately, there are a few circumstances we can’t yet help with:

- Are you in debt crisis? It’s better to speak to StepChange,

the UK’s leading debt charity - Are you likely to retire or withdraw from your pension within the next 5 years and have less than £200k in your pension(s)? It’s better to check out PensionWise or find an adviser through Unbiased.co.uk

- Are you living or working outside the UK? Our technology and advice is all tailored for the UK – including UK tax rules and legislation

- Are you a US citizen? Our technology and advice is all tailored for the UK – including UK tax rules and legislation

What are the risks of investing my money with Octopus Money?

As with any investments, there are risks that the value of the investments will fall as well as rise. These risks are reduced by ensuring you are invested at an appropriate level of risk, and in a diversified, managed portfolio.

Do I have to be a UK resident to use Octopus Money?

Yes, for the time being, you must be a resident and taxpayer of the UK to use our services. That’s because our technology and recommendations are all customised for the UK – including UK tax rules, legislation that applies to UK pensions and other guidance particular to the UK money system.

Unfortunately, we also cannot help US citizens or US dual-citizens.