Getting the most from your first session

Not sure how to prepare for your first session? Read on…

Think about your goals

When it comes to handling your money, there’s not a right way to do it. It’s all about what matters to you and what you’re aiming for.

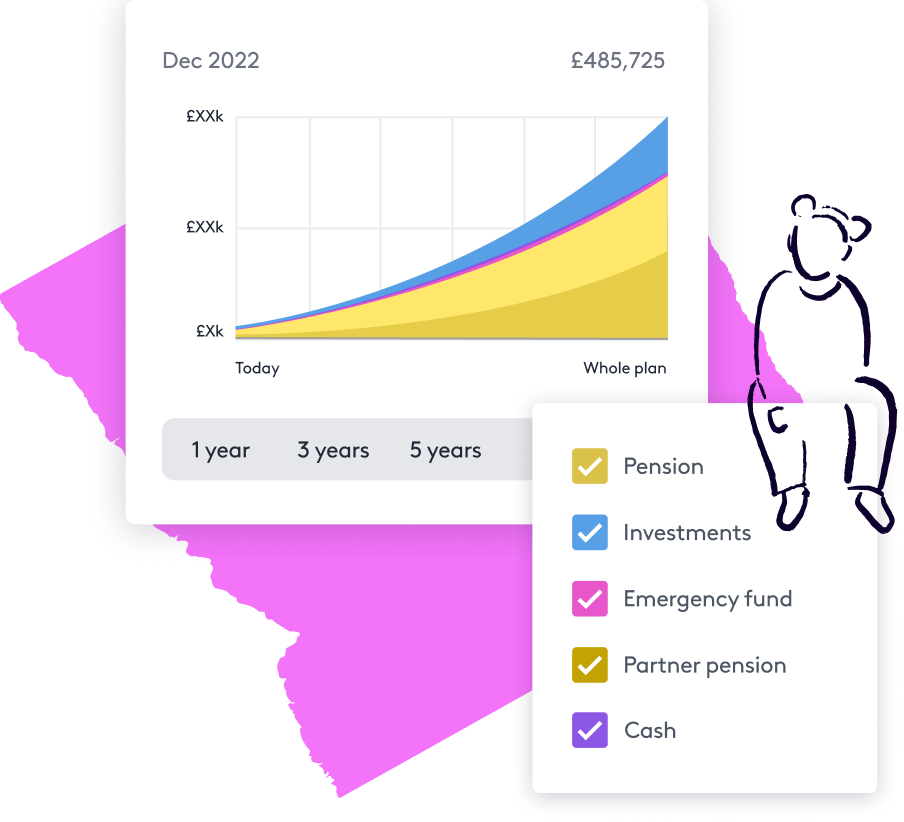

Your first session is all about getting real with your finances. We’ll chat about where you’re at now and what you’re aiming for next. Once we’ve got that sorted, we can help you map out a plan to reach your goals.

Tell us about yourself

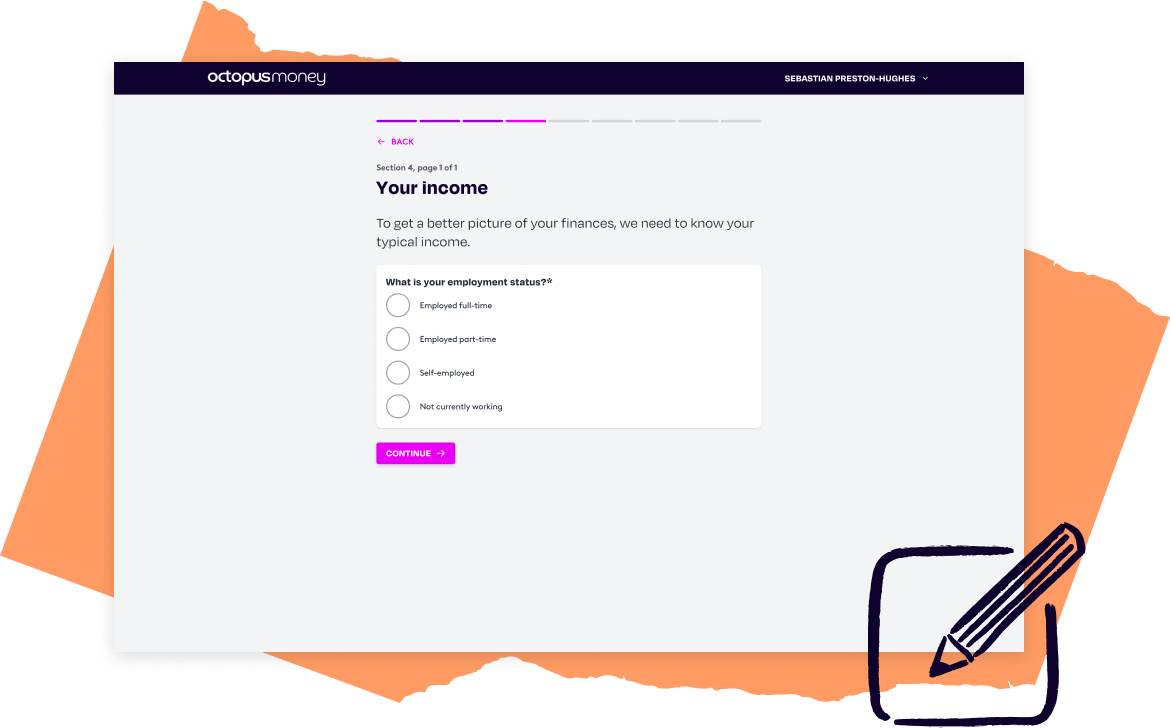

Keep an eye out for a questionnaire heading your way before you speak with us. It’ll give us a better understanding of your financial goals before our session.

Talking about your financial status might feel intimidating at first, but it’s the best way to build a plan. By opening up about things like your income, savings and credit card balances, your coach can make some quick suggestions on things you could improve.

Planning as a couple?

Some goals aren’t just about you. If you’re saving for a home or starting a family, it’s likely a partner is involved too. If that’s the case, let us know, and they’re more than welcome to join your first session.

Top tips for making the most of your session

1

Find a spot where you can chat without interruptions – whether that’s a meeting room at work or a quiet corner at home.

2

Keep an eye out for a questionnaire before your session, and take your time to fill it in. Can’t find it?

3

Be clear on what you want. The best way to make a plan is to start with the end in mind, and it’ll make your conversation much more productive.