We’re very excited to announce that Candid Financial Advice is now part of Octopus Money.

You may already be familiar with one of Octopus Money’s sister companies, Octopus Energy. But Octopus was actually founded in 2000 as an investment company. Today Octopus manages more than £13.5 billion* for investors all over the UK.

Octopus Money was founded with a vision very similar to Candid’s. Transform financial advice for good by focusing on great value, fair pricing and a personal service.

The team of financial advisers at Octopus Money are passionate about building life-long relationships with the people they serve, and the whole team is excited about inviting you to join us.

So right now, what does this mean for you? You’ll continue to work with the people you know at Candid and your investments will stay the same. Over the next few months, the Octopus Money team will be working with Candid to build a greater understanding of your needs, and to ensure they’re well-equipped to best support you in the future.

We know a change like this will mean you’ll have questions, so we’ve included lots of FAQs below. And if you have any questions not covered, please just let us know.

Justin Modray

Director

Candid Financial Advice

Ruth Handcock

CEO

Octopus Money

* Octopus as at 31 March 2024 Funds Under Management data includes undrawn commitments, funds under advisory mandates and funds monitored. It also includes funds under the management of Octopus Renewables Limited.

Your questions answered

Why is Candid being acquired by Octopus?

When Ian and I started Candid Financial Advice over 11 years ago, we set off with lofty ambitions to build a substantial business able to challenge the traditional values and standards within financial advice. I think we’ve been successful with a small ‘s’, and we’re certainly proud of the advice and standards we have set. But, as you know, we have struggled to recruit and retain people able to help us grow the business.

Charging around a third of typical advice firms has been key to our ethos, but it’s meant we struggle to compete in an increasingly competitive labour market. The resulting high staff turnover means Ian and myself are still hands on in just about every facet, with our workloads increasing as both the business and red tape have grown.

So we’ve been looking for a company to partner with who shares our values and desire to provide great advice and service. We believe Octopus Money will be a great home for both our clients and us.

Justin Modray, Candid Financial Advice

Who is Octopus Money?

We’re part of Octopus Group (you may have heard of our famous sister company Octopus Energy). At Octopus Money, we’re on a mission to make friendly, affordable financial planning and advice available to everyone.

We’re a certified B-Corp who strive to offer exceptional customer service, great value and friendly, approachable financial advice. Whatever it is you want to do with your money, we’re here to help make that a reality. Meet the team here.

Oh and one more thing, Octopus Money is the trading name of TW11 Wealth Management Limited. So you’ll see references to this in our emails and on our website too.

Ruth Handcock, Octopus Money

Will this impact my investments?

Right now, this won’t have any impact on your investments. You’ll still be able to login to your platform to get an update on the latest performance, contributions and transactions on your accounts. And the Candid team will still be your point of contact for any questions that you have.

In the meantime, we’ll be working with Candid to get to know you, and how we can support you. So at your next Annual Review, we’ll introduce you to the Financial Adviser at Octopus Money that we’ve determined to be the best match to help you build your finances for the future – and explain what’s different about the Octopus Money service.

Ruth Handcock, Octopus Money

What happens next?

For the time being, there won’t be any changes to the service you receive. You’ll continue to work with the people you know at Candid. In the background, we’ll start working with the Candid team to get to know you, your plans for the future and how we can support you best to make your plans a reality.

When it’s time for your Annual Review, you’ll meet your new Octopus Money Adviser. We’ll work closely with Candid to ensure your new adviser is the right match for you – and they’ll be able to talk you through the Octopus Money service and what’s different to the service you receive from Candid.

Ruth Handcock, Octopus Money

Will my fees stay the same?

Candid and Octopus both believe in financial advice that puts people first and gives clients a fair deal. At Candid, we’ve been proud to offer fees for a fraction of the cost of the rest of the industry – but over time, we’ve discovered that this pricing is just not sustainable for us to deliver an outstanding service to our growing base of clients.

For now, your fees will stay exactly the same. But in time, they may change. Read on for more detail on how this would work, and we’ll discuss this with you 1-on-1 as well.

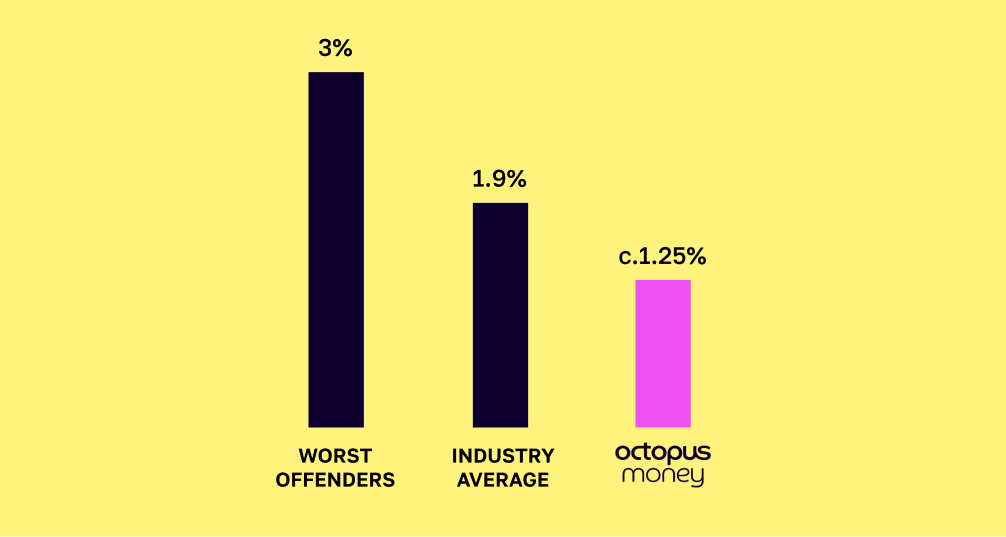

What we found in Octopus was a partner who shares our focus on exceptional value. Octopus’ fees are fair and well below the industry average*. They have some of the lowest product and fund management fees in the market. And they also steer clear of hidden extras you often see elsewhere – like exit fees, fees to top up your investments or fees to switch funds.

Take a look at how Octopus Money’s costs compare to the averages across the financial advice industry:

*Source: Next Wealth FABB Report 2023 / FCA Evaluation of the impact of the Retail Distribution Review and the Financial Advice Market Review

Currently, Octopus Money charges a total fee of 1.25% per year. But they’ll offer you a discount on your advice fee for the next few years. They will increase this gradually each year, until it reaches 0.75% – their standard advice fee.

See what your fees will be over the next 5 years:

This advice fee will be capped at £7,500 per annum. For a complete breakdown of the fees charged by Octopus Money, take a look here (under the ‘Personal Financial Adviser’ tab).

Justin Modray, Candid Financial Advice

Who will I be working with?

Up until your next Annual Review, you’ll continue to work with the team at Candid that you already know. In this time, the Octopus Money team will be making sure we understand your needs, so that we can best support you – as well as find you an Adviser at Octopus Money that’s the right fit for you. Here’s our team of Advisers and planners who are ready to work with you.

Ruth Handcock, Octopus Money

What if I don’t want to join Octopus Money?

We’re committed to giving you the brilliant service that Octopus is famous for. But if you’d rather not transfer your account to us, we understand.

You can reach out to Ian or Justin at Candid, who will be able to explain next steps should you prefer to move to a different advice firm. But there’s no rush to make a decision. In your next annual review, Ian will discuss your options with you.

You’re still very welcome to meet an Octopus Money adviser with no obligation to join us too.

Ruth Handcock, Octopus Money

Get in touch

Contact Candid Financial Advice

Email: hello@candidfinancialadvice.com

Call: 0203 397 7280

Here for you 9-5, Monday to Friday.

Contact Octopus Money

Email:

team@octopusmoney.com

Call: 020 3195 4455

Here for you 9-5, Monday to Friday.