LIMITED TIME OFFER

West Brom Building Society customers can get 50% off financial planning with Octopus Money (terms apply – read more here).

Your own financial plan built with a real money expert

We work you 1-on-1 to sort your whole financial life (from savings to pension) and make sure you’re on track to fund the future you want.

Get started with a free 30-minute session – no strings attached!

For a limited time, West Brom Building Society customers get 50% off the full price (see terms here).

Is it right for me?

IT’S PERFECT FOR YOU IF…

- You want help from a real human, not just a digital tool

- You’ve got financial goals that are more than 5 years away (could be a home, your family, retirement or more)

- You want to optimise your finances to reach your goals

- You’ve already started building some savings

- You’re curious about investing or how to take control of your pension

IT’S NOT RIGHT FOR YOU IF…

- You’re retired and have started accessing your pension

- You plan on retiring in the next 5 years

- You want advice on how to start taking money from your pension

- You want advice on whether your existing investments are right for you

- You’re in debt crisis or want advice on how to manage your debt

- You’re not a UK resident or you’re a US citizen or dual-citizen

Get started with a free session to learn more

Use the calendar, to choose a time that’s convenient for you.

Can’t find one? Leave your details – we’ll find a better slot for you.

How it works

STEP 1

Book your free session

It all starts with a conversation about your dreams. Choose a convenient time for a video call to meet our team.

STEP 2

Tell us about yourself

Before we meet, we’ll send you a questionnaire to learn more about you. The more we understand your situation, the more we can help.

STEP 3

Get your financial plan

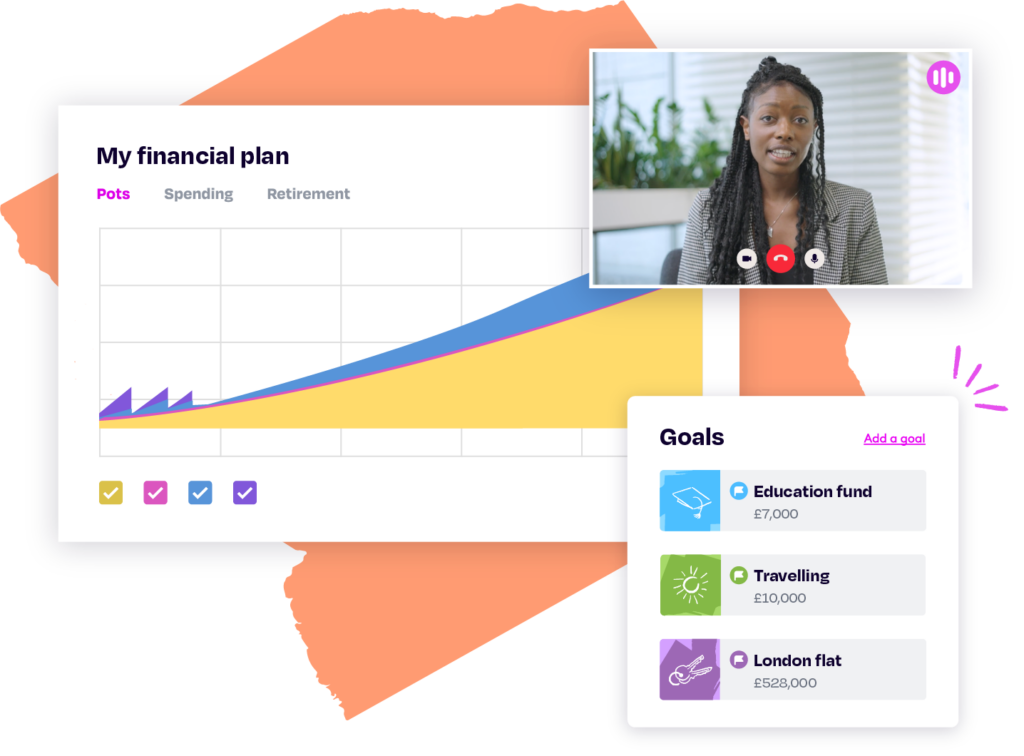

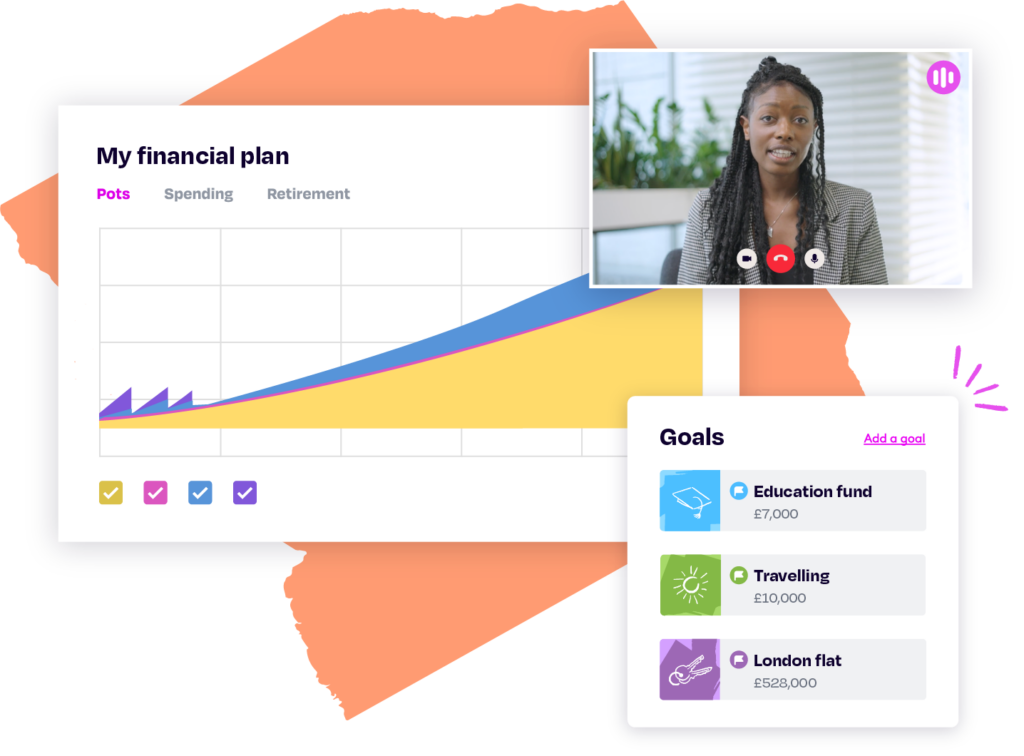

We’ll bring your future to life with a timeline of your goals, alongside all the pieces of your financial life.

STEP 4

Put it into action

Whether it’s sorting your old pensions, setting up an ISA, getting a will and much more…we’re here to help.

What it costs

Fair, transparent pricing that’s 7x more affordable than the industry average.2

1

STEP 1

Your Financial Plan

Get help before you invest. We’ll work with you 1-on-1 to build a personalised financial forecast and action plan around all your goals.

Industry Average2

£2,000

Octopus Money

£299 £149

(50% off for customers of West Brom Building Society)

2

STEP 2

Investment and Pension Advice

Once you have your plan, we can manage your investments and pensions for you, alongside 1-to-1 ongoing advice and catch-ups every year.

Industry Average2

1.9%

From your investments (per year)

Octopus Money

From 1.15%

From your investments

(per year)

Meet our coaches

What is financial planning?

A financial plan is the secret to feeling confident about your finances and how to grow your money.

It’s not a monthly budget. It’s a strategy that tells you exactly how to fund your long-term goals (like homes, kids, weddings, retirement and more). It’s the action plan with the power to turn your dreams for the future into reality.

Read More

When you make a plan with Octopus Money, you’ll get an interactive projection of your financial future, which will account for your goals and any major life events. We’ll also provide a personal set of actions to get you in a better place – including suggestions about your savings, investing, pensions and more.

When we want to get fit or lose weight, we turn to an expert for a diet and exercise plan. A financial plan is the same principle for your money.

“It’s tempting to put off planning our finances. Millions of us delay making a plan because of a lack of time or stress. But the problem is that many of us don’t realise – until it’s too late – that we’re not on track for the future we want. Without a helping hand, we risk making costly mistakes along the way. That’s why everyone should have a financial plan. Especially if you have loved ones counting on you now or in the future.”

Tom Francis

Head of Advice

Join 10,000s of savers who have taken control of their finances

POSTED ON VOUCHEDFOR

Milestones we’ve helped our customers reach

Everyone’s goals are different, but here are some of the most common ones we can add to your financial plan.

Buying a property

Whether you’re saving for your first property or trading up to the house of your dreams, we’ll build you a plan to get there. (And get you the best deal on your mortgage.)

Planning for childcare or education

No one prepares you for the real costs of raising kids…but a financial plan can give you and your family more financial stability. Whether it’s childcare, school fees, university costs or a nest egg you can pass on, we’ll help build the right strategy.

Saving for holidays

Having a financial plan will help you balance your short-term goals – like holidays and big purchases – alongside longer-term goals for your future.

Planning for retirement

It’s easy to be so focused on the here and now, that you forget about the life you want in 10, 20 or 30 years. That’s why 1 in 2 Brits reach retirement without enough money saved in their pension!1 We’ll help you make sure you’re saving the right amounts and investing the right way, so you can retire when you want.

West Brom Building Society Terms & Conditions

- Eligible West Brom Building Society customers get 50% off Octopus Money’s financial planning service.

- This offer is open from 27th November 2024 – 20th April 2025.

- Eligibility criteria applies – see here for more detail.

- The financial planning service:

- is a service that involves making a plan about your financial future to account for your goals and major life events.

- is not regulated by the Financial Conduct Authority (FCA) as it is not a regulated activity in the UK. The financial coaches who provide the financial planning service offer guidance to help you make informed decisions, but they cannot recommend specific regulated financial products or providers.

- does not involve any recommendations or personalised advice on financial products or services that are regulated by the FCA.

- The financial planning service will be provided by Octopus Money who’s terms and conditions will apply.

- All customers who sign up are invited to fill in a questionnaire and receive an initial free starter session.

- After the free starter session, West Brom Building Society customers can then decide whether to go ahead with the financial planning service costing £149.50 for two sessions (usually £299) and with Octopus Money’s coaches producing a financial plan.

- If, after the initial free starter session Octopus Money does not deem the West Brom Building Society customer suitable for the financial planning service it may refer customer to other services it provides.

- West Brom Building Society customers must provide their email address that’s linked to their West Brom Building Society account when signing up.

- West Brom Building Society reserves the right to withdraw or amend this offer at any time.

- Except for liabilities that cannot be excluded by law, West Brom Building Society accepts no responsibility for any damage, loss, liabilities or disappointment incurred or suffered by you as a result of you signing up to the free starter session and any subsequent financial planning sessions.

- West Brom Building Society do not receive any remuneration for the introduction of customers to Octopus Money.

Frequently Asked Questions

Can I try the service before signing up?

Of course! It’s really important that you feel completely comfortable and understand all the ways we can help you with your finances.

We give everyone one free session – no strings attached – to make sure you understand how we work, see if we’re a good fit for you and hear some initial suggestions we’ll have for you.

What sets Octopus Money apart?

- We believe everyone deserves access to 1-to-1 money advice, so we don’t mind how much or how little you have to invest. We’re proud that our financial planning is a fraction of the cost of traditional financial advice.

- We’re proud to put a friendlier face on financial planning. No judgments, no jargon, no salespeople. Great service is at the heart of everything Octopus does. Our coaches and advisers always put you (and your dreams) first. Financial planning is more than numbers. It’s about feeling more confident, more in control and more excited about your future.

- You may know us from our sister companies, but did you know that Octopus was actually founded in 2000 as an investment company? Today Octopus Group is trusted by investors all over the UK to manage over £10 billion.*

- We’ve built our own range of investment portfolios that are globally diversified and have delivered returns that often beat competitive benchmarks (based on data from Asset Risk Consultants). That makes it even easier to go from plan to action.

Who can you help?

We’re here for anyone who wants to get a better grip on their finances, grow their money and get on track for their future goals. No matter what life stage you’re at or how much you have to invest.

We tend to work with people who find themselves too busy to optimise their finances on their own. Or they want to get a second opinion from an expert on how to make the most of their money and avoid costly mistakes.

Customers often come to us when…

- They’re saving to buy a property.

- Their family is growing and they’re thinking about their kids’ futures.

- They’re ready to stop putting off retirement planning and want to make sure they’re on track.

- They’ve got several big goals in mind and I want to build the right strategy to save for all of them in the best way.

What will happen during the Starter Session?

Your first session will last around 30 minutes. The primary purpose is for us to learn more about you and for you to learn more about us, so you can decide if you want to sign up.

After you book a time that works for you, you’ll need to answer a few questions so we can get to know you and your situation a bit better. It’s a great opportunity to dig out old records and get all your finances in one place.

When you join the session, we’ll discuss your current circumstances and any money goals you have in mind. If you don’t have any goals, that’s okay – we can help you come up with some that are important to you.

Then, we’ll suggest which areas of your finances might need attention, and highlight the opportunities and challenges in front of you. These will be general tips and tricks, as we’ll only be sharing our initial thoughts.

Finally, we’ll explain our financial planning service, where we can build you a custom financial plan and help you sort your pensions, investments and more. Then, you can decide whether it’s right for you.

How will my session be held?

All of our sessions are held via video chat. A link to the meeting will be included in the calendar invitation which is sent to you after confirming your booking above.

Do I have to be a UK resident to use Octopus Money?

Yes, for the time being, you must be a resident and taxpayer of the UK to use our services. That’s because our technology and recommendations are all customised for the UK – including UK tax rules, legislation that applies to UK pensions and other guidance particular to the UK money system.

Unfortunately, we also cannot help US citizens or dual-citizens.

Are you FCA-regulated?

Yes, Octopus Money is regulated by the Financial Conduct Authority to provide financial advice (our register number is 763630). The Octopus Money Platform is also protected by the Financial Services Compensation Scheme.

That said, some of the services we provide are not regulated by the FCA. This includes financial coaching, which is not a regulated activity in the UK. Our coaches offer expert guidance to help you make informed decisions, but they cannot recommend specific regulated financial products or providers such as investments, insurance, pensions and mortgages. They learn about your situation and goals, build your financial plan and help you decide the best decisions to make.

To receive regulated investment advice, you’ll use our digital adviser which will take information from your financial plan and intelligently recommend specific investment actions, tailored to your situation and goals. Alternatively, if you have more complex circumstances, you can meet with a regulated financial adviser from our team.

Are the conversations confidential?

Yes! The privacy and security of our customers’ data is our top priority, and we would never share any personal information about you with any third party without your permission.

1Research from Investec Wealth & Investment (UK), March 2024

2“7x cheaper” comes from comparing the average initial fee of £2,000 to our upfront planning fee of £299. The average upfront financial planning fee is sourced from Unbiased, Feb 2024 and the average total ongoing fee is sourced from Which?, Jan 2024. There are many reports of average upfront fees being closer to £5,000, but we’ve intentionally chosen the lowest estimate we’ve seen reported.

*As at 31 December 2024 – Funds Under Management data includes undrawn commitments, funds under advisory mandates and funds monitored, and is based upon the latest information available at the time of the calculation.