Trinity members can get financial planning for £269 (terms apply – read more here).

Proud to support Trinity members with trusted financial guidance

We’ve partnered with Trinity Insurance to give serving personnel, veterans, and their families access to trusted financial planning at a discounted rate.

Get started with a free session – no strings attached!

Trinity members get 10% off the full price

See terms here

The future you want starts with a plan.

At Octopus Money, we believe everyone deserves a clear plan for their future. That’s why we make it easy to speak to a qualified expert who understands your goals, your benefits, and your unique circumstances.

Here’s what you can expect:

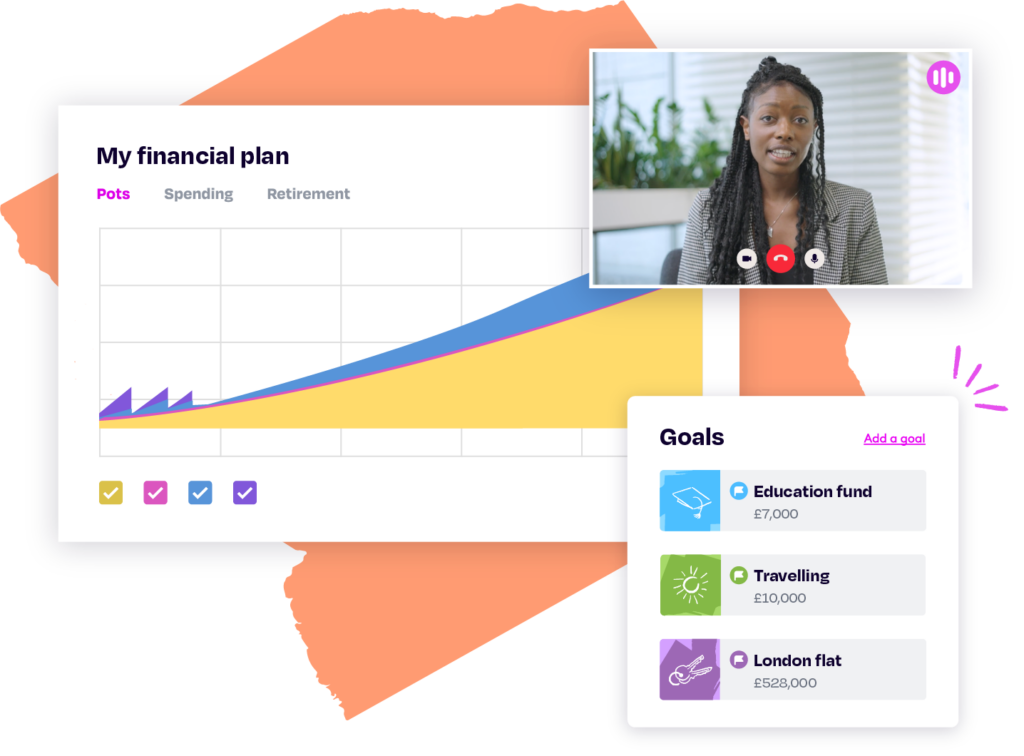

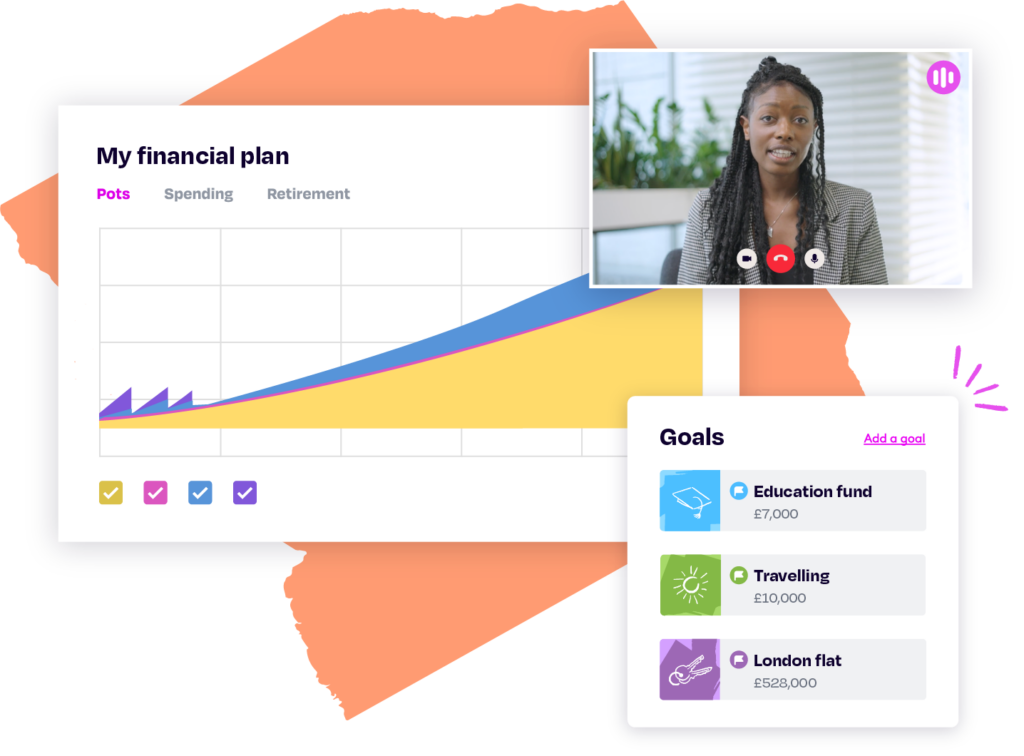

- One free Starter Session to chat about your goals

- A one-to-one Planning Session with a financial expert (60 minutes, via video call)

- A personalised plan to help you feel in control — no matter your starting point

- Support with pensions, savings, retirement, tax and more

Normally £299 for Planning, Trinity members pay just £269.

How it works

STEP 1

Book your free Starter Session

It all starts with a conversation about your goals. Choose a convenient time for a video call to meet our team.

STEP 2

Tell us about yourself

Before we meet, we’ll send you a questionnaire to learn more about you. The more we understand your situation, the more we can help.

STEP 3

Get your financial plan

We’ll bring your future to life with a timeline of your goals, alongside all the pieces of your financial life.

STEP 4

Put it into action

Whether it’s sorting your old pensions, setting up an ISA, getting a will and much more…we’re here to help.

What is financial planning?

A financial plan is the secret to feeling confident about your finances and how to make the most of your money.

It’s not a monthly budget. It’s a strategy that tells you exactly how to fund your long-term goals (like homes, kids, weddings, retirement and more). It’s the action plan with the power to change your financial future.

Read More

When you make a plan with Octopus Money, you’ll get an interactive projection of your finances, which will account for your goals and any major life events. We’ll also provide a personal set of actions to get you in a better place – including suggestions about your savings, investing, pensions and more.

When we want to get fit or lose weight, we turn to an expert for a diet and exercise plan. A financial plan is the same principle for your money.

“It’s tempting to put off planning our finances. Millions of us delay making a plan because of a lack of time or stress. But the problem is that many of us don’t realise – until it’s too late – that we’re not on track for the future we want. Without a helping hand, we risk making costly mistakes along the way. That’s why everyone should have a financial plan. Especially if you have loved ones counting on you now or in the future.”

Tom Francis

Head of Personal Finance

What it costs

Fair, transparent pricing that’s 7x more affordable than traditional financial advice.2

1

GETTING STARTED

Your Financial Plan

Get help before you invest. We’ll work with you 1-to-1 to build a personalised financial forecast and action plan around all your goals.

Traditional Financial Advice2

£2,000

2

ONGOING

Investment and Pension Advice

Once you have your plan, we can manage your investments and pensions for you, alongside 1-to-1 ongoing advice and catch-ups every year.

Traditional Financial Advice2

1.9%

From your investments (per year)

Octopus Money

From 1.15%

From your investments

(per year)

Join 10,000s of savers who have taken control of their finances

POSTED ON VOUCHEDFOR

Is this service right for me?

IT’S PERFECT FOR YOU IF…

- You want help from a real human, not just a digital tool

- You’ve got financial goals that are more than 5 years away (could be a home, your family, retirement or more)

- You want to optimise your finances to reach your goals

- You’ve already started building some savings

- You’re curious about investing or how to take control of your pension

IT’S NOT RIGHT FOR YOU IF…

- You’re retired and have started accessing your pension

- You plan on retiring in the next 5 years

- You want advice on how to start taking money from your pension

- You’re in debt crisis or want advice on how to manage your debt

- You’re not a UK resident

- You’re a US citizen or US dual-citizen

Trinity Insurance Customer Offer:

Terms & Conditions

- Trinity Insurance customers get 10% off Octopus Money’s Financial Planning or Wealth Planning service.

- Trinity Insurance customers must provide the email address that’s linked to their Trinity Insurance account when signing up.

- Octopus Money reserves the right to verify that any email address submitted as part of the offer is valid and associated with a Trinity Insurance product or policy. By taking advantage of this offer, you agree that we may take reasonable steps to confirm your eligibility, which may include checking the domain of your email address or contacting you for further information. We may withhold or withdraw any discount or promotional benefit if we reasonably believe that the eligibility criteria have not been met.

- Financial Planning and Wealth Planning will be provided by Octopus Money whose terms and conditions will apply.

- All customers who sign up for an initial session are invited to fill in a questionnaire for Octopus Money to learn more about their finances and goals.

- After the free starter session, Trinity Insurance customers can then decide whether to go ahead with the Planning Session costing £269 for two sessions (usually £299) with Octopus Money’s coaches or financial advisers producing a financial plan.

- If, after the initial free starter session Octopus Money does not deem the Trinity Insurance customer suitable for either the Financial Planning or Wealth Planning service it may refer customers to other services it provides.

- Trinity Insurance or Octopus Money reserves the right to withdraw or amend this offer at any time.

- Except for liabilities that cannot be excluded by law, Trinity Insurance accepts no responsibility for any damage, loss, liabilities or disappointment incurred or suffered by you as a result of you signing up to a free session with Octopus Money or any subsequent Planning or Action Sessions.

1Research from Investec Wealth & Investment (UK), March 2024

2The statement “7x cheaper than traditional financial advice” comes from comparing an average initial fee of £2,000 charged by financial advisers to our own upfront planning fee of £299. When we say “traditional financial advice” we are referring to services delivered by regulated financial advisers, which often start with by discussing your goals and building a financial forecast and plan. Our service includes some, but not all, of the benefits of “traditional financial advice” – for example, you get to work 1-on-1 with an expert and get a personal financial plan built around your goals, but you will work with a financial coach rather than a regulated financial adviser. The average upfront financial fee is sourced from Unbiased, Feb 2024 and the average total ongoing fee is sourced from Which?, Jan 2024.

*Octopus as at 31 December 2023 – Funds Under Management data includes undrawn commitments, funds under advisory mandates and funds monitored. It also includes funds under the management of Octopus Renewables Limited.